Reevaluating Economic Ambitions: Deciphering the Flawed Proportions of the 5 trillion Dollar Economy

Economists advocating for economic growth put forth two crucial arguments. First, they posit that growth possesses a trickle-down mechanism whereby even if the benefits of growth initially accrue to the upper echelons of income, they ultimately extend to the impoverished segments of society. Second, in instances where this trickle-down process fails to materialize, the surplus generated from economic growth can be equitably reallocated through welfare initiatives. An exemplar of such a welfare scheme is the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), which was enacted in 2006. During this period, India experienced a period of robust economic expansion. However, this prompts the question of whether the government should solely target a specific income threshold.

In the 2000s, the governmental

objectives were not confined to attaining a predetermined income level but were

instead oriented towards cultivating sustainable and balanced economic growth

that concurrently mitigated poverty and inequality. As evidenced by the policy

goals set forth by the 10th Planning Commission (2002-2007), the emphasis was

on achieving a comprehensive, poverty-alleviating, and enduring economic growth

trajectory. This was to be accomplished by efficiently mobilizing and employing

available resources through market-friendly frameworks, policy reforms, and

legal adjustments that fostered an environment conducive to multifaceted

economic, social, and institutional advancement. Structural reforms were sought

to ensure the equitable distribution of returns stemming from the heightened

economic growth.

To achieve

broader, poverty alleviation oriented, high and sustainable economic growth

rate by mobilizing and utilizing effectively the available resources

facilitating the liberal and market-friendly arrangements, with reforms in

policy spheres and legal matters to create suitable environment for economic,

social, and institutional development. Structural reforms will be carried out

for equitable distribution based on geographic and social aspect, the returns

of the high economic growth.

To achieve

high and sustainable economic growth rate, emphasis shall be on identification

and utilization of areas of competitive along with enhancement of competitive

capacity. The role of government in social liability and poverty alleviation

sectors shall definitely be promoted for balanced development.

The role of

government shall be that of catalytic, facilitator, and regulator to strengthen

the liberal and open market oriented economic activities for modern and

organized sectors. The role of private sector, in this perspective, shall be

activated more in such sectors where it has already been more effective and

active, such as agriculture, tourism, industry, commerce, transport,

electricity, communications, information technology, air services and on other

additional promising sectors. The safe vault thus created in government

investment shall be utilized for the development of social sectors,

infrastructures development and other viable areas

(Objectives of 10th

Planning Commission, 2002-2007)

The approach to realize this high

and sustainable economic growth rested on identifying and leveraging

competitive domains while bolstering competitive capacities. The government's

role was envisaged as a catalyst, facilitator, and regulator, primarily supporting

liberal and open market-oriented economic activities within modern and

organized sectors. Private sector involvement was promoted, especially in

sectors where it had already proven effective, such as agriculture, tourism,

industry, commerce, transport, electricity, communications, information

technology, and aviation, as well as in other promising domains. The resources

thus accrued from government investments were to be judiciously allocated to

foster the development of social sectors, infrastructure, and other viable

realms.

The crux of public policy during

this period was not confined to reaching a specific income benchmark, but

rather to cultivate an environment that would enable the attainment of a

heightened economic growth rate. The overarching goal was to ensure that this

growth rate was sustainable and inclusive, enlarging the economic pie while

concurrently fostering equity. In stark contrast, the current aspiration of

achieving a five trillion-dollar economy does not prioritize redistribution or

the trickle-down mechanism. Instead, its sole focus is the expansion of the

economic pie.

The target is to contribute 1

trillion dollars from agriculture and allied activities, 1 trillion dollars

from manufacturing, and 3 trillion dollars from the services sector.

(Press

Information Bureau, Government of India, Ministry of Commerce & Industry,

Dated: 11 OCT 2018 6:29PM by PIB Delhi).

Such targeted objectives have the

potential to yield unbalanced economic growth. This disparity in growth extends

beyond mere individual-level inequality and permeates into regional

discrepancies across states. India’s growth rate is already not able to

generate the equitable results which also highlights the limitation of public policy.

This is particularly evident in the Indian context, where the prevailing growth

rate fails to engender equitable outcomes, thereby underscoring the limitations

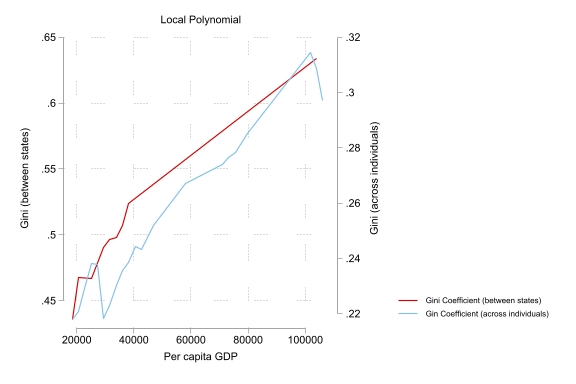

of existing public policy measures. This issue is visually depicted in Figure

1, which portrays trends in per capita GDP, the Gini coefficient computed using

individual income data, and the Gini coefficient computed using per capita GSDP

(Gross State Domestic Product) data, weighted by population. Both Gini

coefficients exhibit an upward trend in tandem with the per capita GSDP.

Figure 1: Gini Coefficients and Per capita GDP for India

The local polynomial graph

effectively illustrates that at higher levels of per capita GSDP, a notable

degree of regional inequality, as well as individual-level inequality, becomes

evident. Surprisingly, the scenario contrasts with that of China, where a

different pattern emerges.

Figure 2: Local Polynomial graph for India

This observation becomes apparent upon reviewing the figure provided. The measure of inequality, computed based on individual income, displays a distinct inverted-U pattern. Initially, it experiences an upward trajectory before subsequently declining, all the while per capita GDP continues to rise.

Figure 3: Gini Coefficient and Per capita GDP for China

The scatterplot further

reinforces this pattern, revealing a similar trend where the relationship

between the Gini coefficient and per capita GDP appears to follow an inverted-U

shape. Initially, the Gini coefficient rises with the increase in per capita

GDP, but subsequently, it starts to decline as per capita GDP continues to

rise.

Figure 4: Local Polynomial - Scatter Plot for China

This phenomenon is similarly

observable when examining disparities across states. The video presentation

demonstrates Kernel Density Estimation Plots for both Indian states and Chinese

sub-national regions. Notably, the Kernel Density plot for Indian states

transitions into a multi-modal distribution toward the lower end of values.

Conversely, the plot for China maintains a unimodal distribution with a

pronounced peak at higher values.

Figure 5: KDE plots for India and China

The emergence of a multi-modal Kernel plot for Indian states implies the presence of distinct groups or clusters among states at various income levels, representing the persistence of regional disparities.

Consider a hypothetical scenario wherein India is faced with the sole option of achieving a 5 trillion dollar economic target. In order to address this scenario, I conducted a series of mathematical calculations and employed linear optimization techniques.

To begin, I utilized the Gross State Domestic Product (GSDP) figures at constant prices, subsequently aggregating them to obtain the Gross Domestic Product (GDP) at the national level. I incorporated a GDP deflator value of 1.30, derived as the average for the 2010-2020 period, which I then converted into current prices. Employing an exchange rate of 80 Rupees per Dollar, I further converted this value into GDP at current prices in dollars.

Next, focusing on a retrospective analysis of the past decade, I computed the average annual growth rate for each state's GSDP. I retained these growth rates and employed them to extrapolate GSDP and GDP values for the year 2025. Subsequently, I conducted a straightforward linear optimization procedure with the aim of attaining a 5 trillion dollar GDP by 2025, achieved by manipulating the aforementioned growth rates.

As anticipated, the optimization process yielded heightened growth rates for the leading state economies in terms of GSDP (Gujarat, Maharashtra, Tamil Nadu and Karnataka). This outcome underscores that in order to realize a national GDP of 5 trillion dollars, states at the forefront of economic performance must excel further. Consequently, this implies that these prominent states would experience elevated growth rates, potentially exacerbating the existing economic disparity among different states.

Table 1: Growth rate required for Top states (Gujarat and Maharashtra) and Bottom States (Uttar Pradesh and Bihar)

Opting for a strategy that prioritizes facilitating market dynamics to stimulate higher economic growth, coupled with the implementation of welfare schemes aimed at redistributing the generated surplus, represents a promising and pragmatic approach. This approach veers away from direct income level targeting and capitalizes on the dynamics of market forces to drive economic expansion. Simultaneously, it recognizes the need to address inequality and disparities by channeling the surplus resources generated from growth into schemes that promote equitable redistribution, thus fostering a more inclusive and sustainable economic landscape.

PS:

Does 5 trillion dollars at current prices make any sense? Not at all.

Figure 6: GDP in trillion dollars (Current and Constant prices of 2011-2012) and CPI

टिप्पण्या

टिप्पणी पोस्ट करा