(Crony) capitalism is killing the competition????

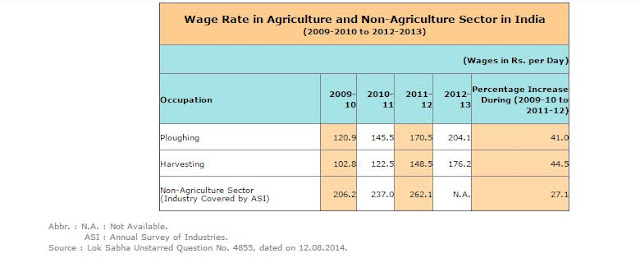

I just finished the book called “Gas Wars: Crony Capitalism and the Ambanis” written by Paranjoy Guha Thakurta, Subir Ghosh and Jyotirmoy Chaudhuri. The book explained the relationship between RIL (Reliance Industries Limited) and government especially the relationship between energy minister, petroleum minister and RIL. These ministers were working for RIL and if you observe that these energy and petroleum minister held their position continuously for five years which are exceptional cases for given ministries.

In 2014, Reliance must realize the mood of the nation and moved towards BJP. So in this article, I am trying to observe whether the competition in the industries where Mukesh has a stronghold is reduced or not in Post-Modi era. I have calculated the HHI (Herfindahl-Hirschman Index) to measure the competition. The index is calculated by summing the square of the top 10 companies share. If HHI is higher then there is less competition while if HHI is low then competition is high.

Telecommunication:

Reliance Jio Infocomm Ltd. is a private limited company incorporated on 15 February 2007. In 2015, Jio soft was launched which became publicly available in 2016. At the end of the 2019 year (March 2019) the revenue of Reliance Jio Infocomm is Rs.457,880 million. Akash Ambani, Isha Ambani, and Manoj Modi are director while Sanajy Meshruwala is Managing Director. There are other competitors like Bharti, Vodafone-Idea, Tata Communication, etc.

It is clear that till 2014-15, HHI was declining which means competition was increasing but after Jio’s entry, HHI graph shows the spike. The entry of one firm in the market should increase the competition in the market but this is not happening in this case. Remember HHI is still low while is around 0.12 which indicates the competition but it is higher compared to 2009’s HHI.

Retail:

Reliance Retail Ltd. is a public limited company incorporated on 29 June 1999. On 31st March 2019, the revenue of Reliance Retail is Rs.1,159,131.6 million.

The author calculated HHI by using sales data for Retail industry provided by CMIE (extracted from Prowess).

Again Index shows the spike in 2016-17. Again HHI shows the high-level competition but it’s high compared to 2009’s HHI.

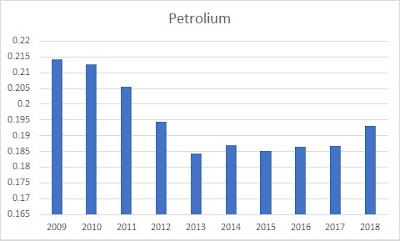

Petroleum:

Reliance Petroleum Limited (RPL) owned by Reliance Industries Limited (RIL) is one of the largest private sector companies (which is a center point of all controversies).

The author calculated HHI by using sales data for Petroleum Products industry provided by CMIE (extracted from Prowess).

Interestingly in this sector, from 2009 to 2012-13, HHI is high. Remember in the period 2009 to 2011-12, Reliance has witnessed CAGR of 30.2% which was highest compared to Bharat Petroleum, Hindustan Petroleum, and Indian Oil. And this can be viewed as a supportive argument to the views given by Paranjoy Guha Thakurta. Reliance tried to prevent its close relationship with the government. 2013-2014 was the period where Reliance deliberately stayed away from government because of realization of MODI wave (Reliance was very close to the Congress from its birth but Parimal Nathwani, two time MP from Jharkhand and in charge of RIL’s corporate affairs and known as Modi’s man in Reliance changed the whole scenario.)

Now after 2015, HHI is showing an upward trend. Again in the same period, CAGR for RPL is 15.3% which is high compared to other players.

It is true that by show HHI, we can’t comment on the relationship between Reliance and Government. But it is also true that if the government tries to preserve someone’s interest in the market, then it reduces the competition which is not a good thing.

(Continued)..

Update:

Profit after tax in the telecommunication sector

Data Source: CMIE

Data Source: CMIE

In 2020, the all gain for the com sector is negative. And out of the ten gainers in 2020, 2 players have seen negative gains while Reliance Jio has seen the continuous growth in the profit after tax.

The second figure suggests that the overall income and expenses are declining. One can say that the active activities are not good in 2020 but the concentration is increased (HHI is increased from 0.13 to 0.36. That's a huge jump). This is not a good sign.

TRAI (Telecom Regulatory Authority of India), CCI (Competition Commission of India) should prevent the completion in the given sector.

.jpeg)

टिप्पण्या

टिप्पणी पोस्ट करा