Scope of monetary policy in India: Monetization of Fiscal deficit?

The world is witnessing a crisis bigger than the previous crisis. The responses from the central bank are incredible and rare.

The monetary tools can be categorized into four main categories. First, today is a short-term interest rate that influences the cost of funds in the system. It also plays an important role as far as signals in the system are concerned. The second tool is lending to financial institutions to manage liquidity. Lending can be targeted to support certain segments. The third tool is asset purchases (assets can vary from government bonds to private sector securities like corporate bonds, equity, etc. This again can affect the liquidity. The fourth tool is regulation and supervision. The regulations like reserve requirements, capital, liquidity requirements can affect the markets.

In the advanced economies interest rate is close to zero lower bound. And that puts restriction over the central bank as far as the interest rate is concerned. As far as the Reserve Bank of India is concerned, India is also at a historical lower bound. On May 22, 2020, RBI reduced the policy rate by 40 basis points from 4.4 percent to 4.0 percent. With that announcement, RBI introduced some additional measurements.

(A) measures to improve the functioning of markets and market participants;

(B) measures to support exports and imports;

(C) efforts to further ease financial stress caused by COVID-19 disruptions by providing relief on debt servicing and improving access to working capital; and

(D) steps to ease the financial constraints faced by state governments.

Under Measures to Ease Financial Stress, RBI introduced the following measurements:

(a) granting of 3 months moratorium on term loan installments;

(b) deferment of interest for 3 months on working capital facilities;

(c) easing of working capital financing requirements by reducing margins or reassessment of the working capital cycle;

(d) exemption from being classified as ‘defaulter’ in supervisory reporting and reporting to credit information companies;

(e) extension of resolution timelines for stressed assets; and

(f) asset classification standstill by excluding the moratorium period of 3 months, etc. by lending institutions.

On October 9, 2020, RBI kept the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4.0 percent.

"The MPC is of the view that revival of the economy from an unprecedented COVID-19 pandemic assumes the highest priority in the conduct of monetary policy. While inflation has been above the tolerance band for several months, the MPC judges that the underlying factors are essentially supplied shocks which should dissipate over the ensuing months as the economy unlocks, supply chains are restored, and activity normalizes. Accordingly, they can be looked through at this juncture while setting the stance of monetary policy. Taking into account all these factors, the MPC decides to maintain the status quo on the policy rate in this meeting and await the easing of inflationary pressures to use the space available for supporting growth further"

(Monetary Policy Statement, 2020-21 Resolution of the Monetary Policy Committee (MPC) October 7-9, 2020)

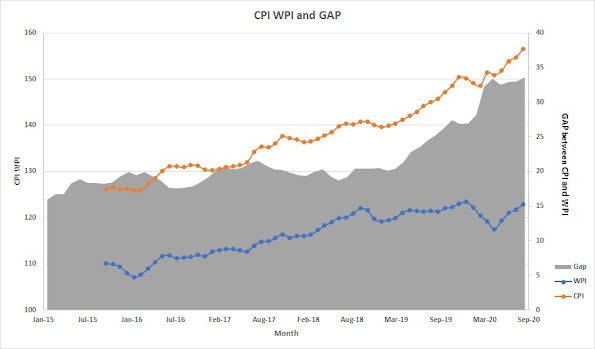

Headline CPI inflation increased to 6.7 percent during July-August 2020 as pressures accentuated across food, fuel, and core constituents on account of supply disruptions, higher margins, and taxes. One year ahead inflation expectations of households suggest some softening in inflation from three months ahead levels. The selling prices of firms remain muted, reflecting the weak demand conditions.

(Monetary Policy Statement, 2020-21 Resolution of the Monetary Policy Committee (MPC) October 7-9, 2020)

CPI inflation is increasing. And therefore RBI didn't change (reduced) the rate. But on the other hand, it is also highlighted that the demand is still weak. The pricing power of the firm is weak. This suggests that inflation is there but firms are not witnessing or perceiving that high level of prices.

Fig one: WPI and CPI

Source: MOSPI and DIPP

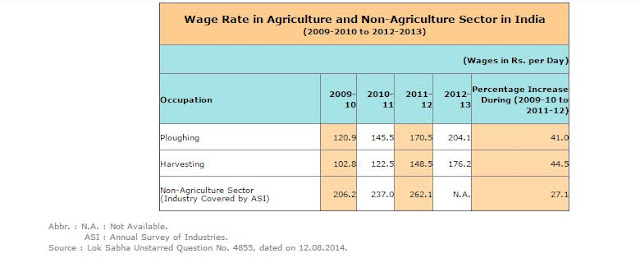

Fig two: Weights

Talking about other interventions, one must understand that this is not a financial crisis or a crisis originated from financial markets. This is not a financial crisis where there is no trust in financial institutions. The measurements related to Ease Financial Stress are required but these measurements should be supplementary. These measurements should not be perceived as the main steps. As this crisis is different from the previous crisis, we want direct benefits. The (monetary) transmission mechanism is a secondary thing. Under the current situation, monetary policy should be designed as a support to the fiscal policy. Fiscal policy should be expansionary and monetary policy should monetize the fiscal deficit caused by the expansionary fiscal policy. The monetization of the fiscal deficit should be a primary aim. Buy government securities to fund government expenses, spending. And rate should be designed in a such way that inflation will remain in a tolerance band.

This doesn't mean that monetary policy has no value. The central banks always learn from the crisis and construct innovative tools and implement them. There is no doubt that post-Pandemic, the Central bank will use some new innovative tools to tackle the problems.

टिप्पण्या

टिप्पणी पोस्ट करा