A Better for Government to Save but what after pandemic?

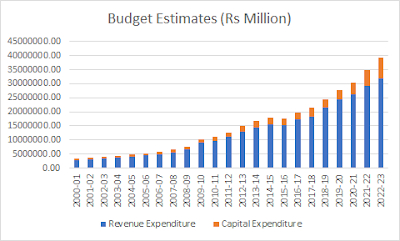

The capital expenditure is supposed to be counter-cyclic meaning it should increase in crisis (in bad times) and should adjust in good times. The current expenditure includes government spending for services like health and education, the wage bills of public employees, current transfers made by the government (for example, to pay for social programs and subsidies). Current expenditure is also important firstly as it covers spending for basic services like education, health, and secondly, it encourages the demand in the economy.

Considering only a pandemic-driven crisis, capital expenditure should be increased because disturbances in demand due to a pandemic can be resolved once supply-side issues get addressed by the market as well as the government after settling the supply chain properly. But India has long-lasting demand issues that are originated in the pre-pandemic period which has to be addressed through current expenditure. We can discuss this issue next chapter. Now coming back to capital expenditure, I have some specific issues.

Budgetary allocation for capital expenditure is increasing while current expenditure allocation is also increasing. But.. if I divide these expenditures into schemes wise expenditure then we can find some specific issues. The actual expenditure as a percentage of budgetary estimates is above 100% but capital expenditure for centrally sponsored schemes, it is very less which suggests that for centrally sponsored schemes, the actual capital expenditure compared to budgetary allocation is very less. This highlights an important question: Do we really want CSS? or that can be restructured and finance can be scheduled through other grants or even through compulsory transfers?

The % of BE for capital expenditure for centrally sponsored schemes is very low compared to all including revenue expenditure as well. What does that mean? It means if 100 Rs is allocated in budget then only 40-60 Rs are actually spent by centre. What is centrally sponsored schemes exactly? Centrally sponsored schemes are schemes which are financed by both state and centre. So it means if 100 Rs are allocated for capital expenditure for centrally sponsored schemes then centre is providing only 40-60 Rs to states. If centre is unable to provide the total amount then why centre is just shifting the burden on states? Should we really continue such scheme with such inefficiency? Andhra Pradesh in 2014 demanded the scrappingg of Centrally Sponsored Schemes and instead of CSS, centre should adopt the better devolution. Another issue related to CSS is that one uniform policy for all states in India doesn't work due to diversity India has. NITI Ayog and other committee for CSS suggest the CSS should be "restructured" and "rationalized". But instead of CSS, if grants are allocated, then will it help state as it adds flexibility as well as surety of getting the 100% grants?

टिप्पण्या

टिप्पणी पोस्ट करा