Political stability… It does matter for economics also..

Now-a-day, we have strong political stability. But past was little bit unstable. India has witnessed POLITICAL DRAMA in 1980s and even in 1990s. We have experienced several wars also. These things are important not only for political and social conditions but also for economical situation.

Let’s see.

I have created a coding for political stability. In India, resignation of prime minister means abolition of council of minister and loksabha. So ideally P.M. should complete full five years. So suppose X person completed his full years as a P.M. then corresponding years would be coded as 1 (it means government was stable in these years.). Now suppose Y person couldn’t be there as P.M. for 5 years. He ruled (let’s say) only for 2 years then code for corresponding years would be 365*2/365*5 (365*5 are ideal days and 2*365 days were practically stable days.). For emergency, I have given -1 code. One might say that the dictatorship is the most stable (with compare to democracy) and that’s why emergency period should be coded as 1. But we are taking in the context of democracy and in the context of democracy, such kind of incidents are simple invalid.

Now we have several wars. And wars have also an impact on government stability. We should consider it also. So suppose war is fought for 45 days then 45/365 (45 days are unstable days in given year.) would be subtracted from the corresponding year’s code.

Fig 2

Now observe the fig no. 2. The trends of stability and gdp growth rate (gdp growth rate/10 for simplicity) are very similar. Except 2008, graphs are very similar. We know that in 2008, there was a financial crisis therefore the given downfall was because of international fluctuation.

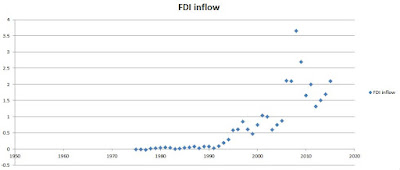

Generally we connect political situation with FDI. But there are certain other undetermined factors through which such type of instability affects economy.

Fig 3

If we see fig 3, FDI is actually increasing but still there are fluctuations in growth rate. Fall and rise in growth rate during unstable and stable government is not actually because of FDI. It might be because of other factors like government expenditure, trust on government, trust on system and skeptical market. In next article, I will try to find out the reasons behind this relationship.

(Data sources – world bank - http://data.worldbank.org/)

(Note – I have taken only major wars like Sino-India, Indo-Pak wars, Indian intervention in Sri Lanka. I have ignored the internal conflicts.).

.jpeg)

टिप्पण्या

टिप्पणी पोस्ट करा