Students for Farmers... article no. 1

Farmers are in Delhi, demanding special session for agricultural issues. To support their protest, I am trying to highlight the main issues through small articles.

Let's first discuss the main highlighted issue: APMC and Prices...

The agricultural prices are always debated on every platform. In 1960s several states passed the Agricultural Product Market Committee act. The main aim of this act was to provide an efficient marketing system and effective infrastructure for marketing of agricultural produce. All produce should be brought to the market yard first and be sold through auction so that farmer would get proper returns. Old APMC act didn’t allow any kind of private player to take part. There was no place for contract farming. But now APMCs act is amended and there is a provision for contract farming. According to the new act, private person, farmers can set up their own market. However, there are still problems. Agents i.e. middle-men are taking the advantages of given system. APMC institutional approach can’t solve these problems because APMC markets have their own drawbacks. There are multiple intermediaries which reduce the farmers’ profit and increase the cost of agricultural commodities. Farmers are exploited by middlemen and agents (Planning Commission. (2011)). The implementation of the APMC act is not even. The law related to agricultural marketing is implemented unevenly in different states and achievement and problems are also different (Vijayshankar, P. S., & Krishnamurthy, M. (2012)). There are large differences in the prices of agricultural commodities (Chatterjee, S., &Kapur, D. (2016)). An intervention of government in procurement and support price and regulation are correlated with price variation of agriculture commodity markets. This price variation is very important because the producer is getting different prices and consumers are also paying a different price at a different location (Chatterjee, S., &Kapur, D. (2016)). Ramesh Chand (Act, A. P. M. R. (2012) observed the huge difference between the price received by producer and price paid by the consumer in agricultural marketing.

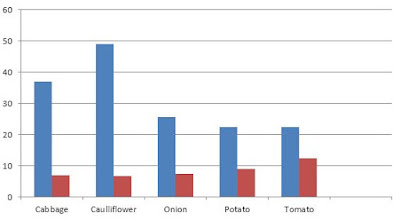

Expenditure of vegetable market yard (in Lakhs Rs)

(Source- Author uses data from the department of agriculture and cooperation for calculation)

If you observe the figures carefully, you will find that the salaries and administrative expenses are very high but repairing and maintenance expenditure are low which shows the poor maintenance of the infrastructure and non-productive expenditure. State Ministers’ Committee on Agricultural Marketing Reforms, July 2014 recommends the linking of mandi fees with the services and infrastructures which are provided for agricultural commodities. But failure in maintaining the infrastructure leads to the post-harvest loss of agricultural commodities. And due to that, the producers are getting less amount.

Percentage losses (cereals) in Millennium and ICAR study

(Red- ICAR study (2010), Blue- Millennium study (2004))

(Source- Author uses data from Final Report of Committee of State Ministers for calculation).

The overall result of the existing structure is the less realization of the prices to the producer.

Now talking about minimum support price, there are news articles which shows that the auctions in the APMC market are not transparent. The prices are settled below the MSP which is illegal but still happening. But for simplicity, let's assume that the farmers are getting MSP.

Now that MSP is still below to the values of the exported and imported agricultural commodity.

Wheat prices (per kg)

(Source – Author uses data from World Bank, Ministry of Agriculture GoI for calculation)

Pulses prices (per kg)

(Source – Author uses data from World Bank, Ministry of Agriculture GoI for calculation)

The export value and import values for per kgs are calculated by dividing the total value of export and import by total exported and imported quantity.

If you observe the prices of wheat and pulses then you will find that the export and import values are higher than the MSP. As we know that the price of petrol is calculated by the parity price mechanism. 20% is for export parity price (the export price of the petrol if we export it to the international market) and 80% is for import parity price (the import price of the petrol if we import it directly from the international market). If the same calculation is done for agricultural commodities, then the obtained parity price is much higher than the MSP in the case of the wheat. In the case of the Pulses, for 2010 and 2011, the parity price is lesser than the MSP but for remaining years, it is higher than the MSP.

Therefore the pricing mechanism and the leakages in the APMC markets are the core issues which should be addressed as soon as possible.

टिप्पण्या

टिप्पणी पोस्ट करा